5 Lagged reactions to announcements

As noted earlier, the first papers to use event studies to examine market efficiency typically found evidence consistent with the market being efficient. However, since those early studies, improved methodologies and data have resulted in a steady increase in the evidence against market efficiency.

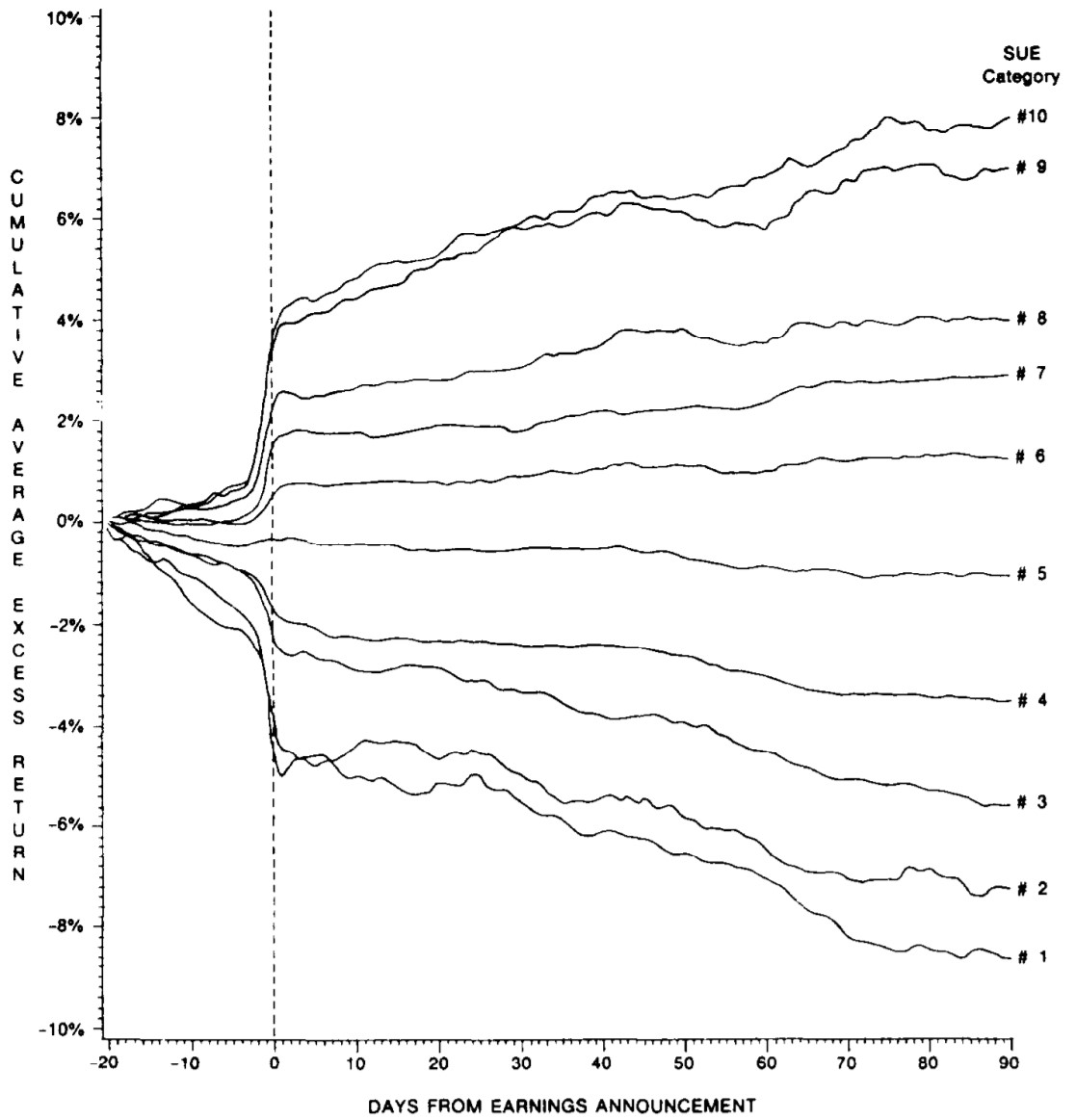

One example of a study questioning market efficiency was by Rendleman et al. (1982), who examined data around quarterly earnings announcements for around 1000 firms between 1972 and 1980. For each announcement they determined the extent to which the actual earnings varied from the forecast earning per share.

Unsurprisingly, they found that the market responds positively to positive surprises and negatively to negative surprises. That is consistent with the efficient markets hypothesis.

However, they also found continual drift in prices following the announcement, particularly announcements that involved a large surprise on either the upside or downside. This is inconsistent with market efficiency. It suggest either an under-reaction to the announcement, with the full reaction delayed, or an over-reaction in the long-term.

5.1 Potential explanations

In a review of the literature on post earnings announcement drift, Fink (2021) notes the following possible explanations:

- A stock’s 52-week high provides an anchor. If a stock is close to the 52-week high, investors underreact to positive surprises. This leads to a subsequent upward drift. Conversely, investors under-react to negative surprises where stocks are far from their 52-week highs. This leads to a subsequent downward drift.

- The disposition effect is the tendency for investors to sell stocks that are in the gain domain relative to the purchase price and to hold stocks that are in the loss domain (Shefrin and Statman (1985)). The disposition effect will impede price adjustment following positive or negative news as investors will tend to sell after positive announcements and hold after negative announcements.

- Distractions or a complex environment can make it harder for investors to process earnings surprises. Post-announcement drift tends to be larger where there are more announcements on the same day or there is high market volatility.